Manufacturing Sales and use tax determination and exemption certificate management. Consumer use tax Buyer-owed taxes. Rebecca Salinas , Digital Journalist. Muhammad Nsereko Indep. Shadow Minister of Finance, Hon. Cash will be subtracted from a Member's account at the time the Member requests a reward. Texas lawmakers added those products under tax exemptions in Senate Bill , which was signed into law by Gov. Energy Tax compliance for energy producers, distributors, traders, and retailers. The details of such bonus Pampers Cash will be provided at the time the offer is made. Lugoloobi said that several businesses are migrating online and so are measures for taxing such transactions. Enterprise solution An omnichannel, international tax solution that works with existing business systems. Greg Abbott following the 88th Legislature. The Florida Legislature will need to approve this massive tax break package in next year's legislative session — which is scheduled to run from March 7 to May 5 — before it can become a reality. Ron DeSantis announces tax-free baby item proposal.

Support Reach out. Although we hope you'll find this information helpful, this blog is for informational purposes only and does not provide legal or tax advice. Starting September 1, , there will be no tax on tampons, diapers, or a number of other family care products in the Lone Star State. Rewards may be available only in limited quantities and will be distributed on a first-come, first-served basis. Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders. Nevada — In June , Nevada legislature passed a bill to exempt diapers from sales tax. Avalara Exemption Certificate Management Collect, store, and manage documents. Period products, diapers, baby bottles will be tax free in Texas starting Sept.

1. Eligibility.

Financial services and banking Oil and gas Healthcare Lodging and hospitality. Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders. A bill of its kind has been pushed by Democrats for at least four legislative sessions, State Rep. Retail Sales tax management for online and brick-and-mortar sales. Supply chain and logistics Tariff code classification for cross-border shipments. Use our templates to help craft your letter and automatically find the state legislators representing you. This disclaimer of liability applies to any damages or injury caused by any failure of performance, error, omission, interruption, deletion, defect, delay in operation or transmission, computer virus, communication line failure, theft or destruction or unauthorized access to, alteration of, or use of your registration information, whether for breach of contract, tortious behavior, negligence, or under any other cause of action. Support Reach out. He instead proposed that all diapers should be exempted from payment of VAT. Software Tax compliance for SaaS and software companies. Corporations or other entities or organizations of any kind are not eligible for the Loyalty Program. If Member has any questions, Member may contact us through the Contact Us link on the Pampers website.

Florida's governor wants diapers, strollers, cribs to be tax-free permanently

- The bill went into effect on August 10,

- Wound care dressing.

- Legislation Partners Remittance Wayfair E-invoicing.

- Stripe Invoicing.

- The Loyalty Program and all Pampers Cash expires not later than p.

Legislators have approved a tax on diapers and rejected a proposal to exempt payment of taxes on adult diapers. The Bill proposed exemption on payment of tax on adult diapers but the Members of Parliament put up a spirited fight against the proposal. Shadow Minister of Finance, Hon. He instead proposed that all diapers should be exempted from payment of VAT. The Leader of the Opposition, Hon. Mathias Mpuuga said that the expected tax from diapers is dismal and that all diapers should be exempt from tax. Muhammad Nsereko Indep. The MPs also introduced a tax on non-resident producers of electronic services such as e-Bay, Amazon, Ali express, Netflix, Facebook, Twitter and Google who are offering services to non-taxable persons in Uganda. Dicksons Kateshumwa NRM, Sheema Municipality however, sought clarification on how this tax would be enforced since the companies are non-resident. Who is going to pay because that is very important for us to determine the ultimate burden on whom it is going to fall under? Lugoloobi said that several businesses are migrating online and so are measures for taxing such transactions. Search form Search. You are here Home » media » news » MPs approve tax on diapers. MPs approve tax on diapers. Posted on:.

Rebecca SalinasDigital Journalist. Avery EverettMultimedia Journalist, pampers tax free. Texas lawmakers added those products under tax exemptions in Senate Billwhich was signed into law by Gov. Greg Abbott following the 88th Legislature. The bill becomes law on Friday, Sept.

Pampers tax free. Florida's governor wants diapers, strollers, cribs to be tax-free permanently

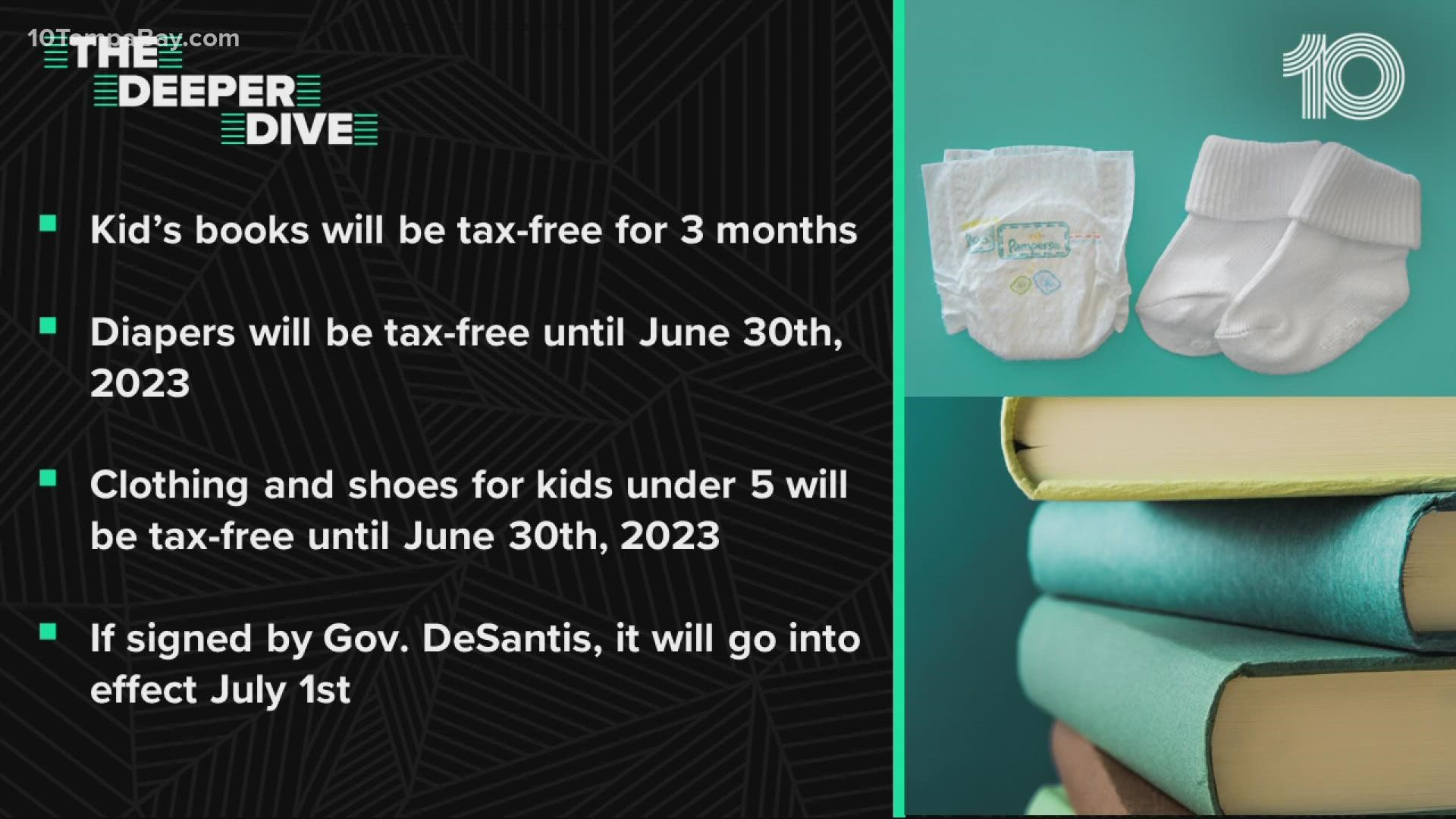

The governor is proposing a permanent sales tax exemption on baby necessities like diapers, strollers and cribs. So that could be pretty significant for folks, particular for folks that have big families. Finally, the governor wants a one-year sales tax exemption on all pet food and over-the-counter pet medications. DeSantis is also aiming to expand Florida's annual back-to-school sales tax holiday to a total of four weeks next year, pampers tax free, with two weeks of tax breaks leading into the fall semester and two weeks leading into the spring semester. The sweeping proposal is an extension of a major tax relief plan that's currently pampers tax free effect for Florida families. Children's diapers, as well as clothing and shoes pampers tax free kids who are 5 and under, are tax-free until June 30, The Florida Legislature will need to approve this massive tax break package in next year's legislative session — which is scheduled to run from March 7 to May 5 — before it can become a reality. Money Consumer. Actions Facebook Tweet Email. Florida's governor wants diapers, pampersy pampers online, cribs to be tax-free permanently Gov. By: Matt Papaycik. Ron DeSantis announces tax-free baby item proposal, pampers tax free.

DAILY NEWSLETTER

As of July 30, , 26 states currently charge sales tax on diapers. In many states, cities and counties can add additional tax. Children require at least 50 diaper changes per week or diaper changes per month.

Virginia — Inpampers tax free, Virginia classified diapers as necessities similar to food and dropped the tax rate to 1. The bill will go into effect on January 1, The governor is proposing a permanent sales tax exemption on baby necessities like diapers, strollers and cribs.

New Law Makes Diapers Tax-Free

0 thoughts on “Pampers tax free”