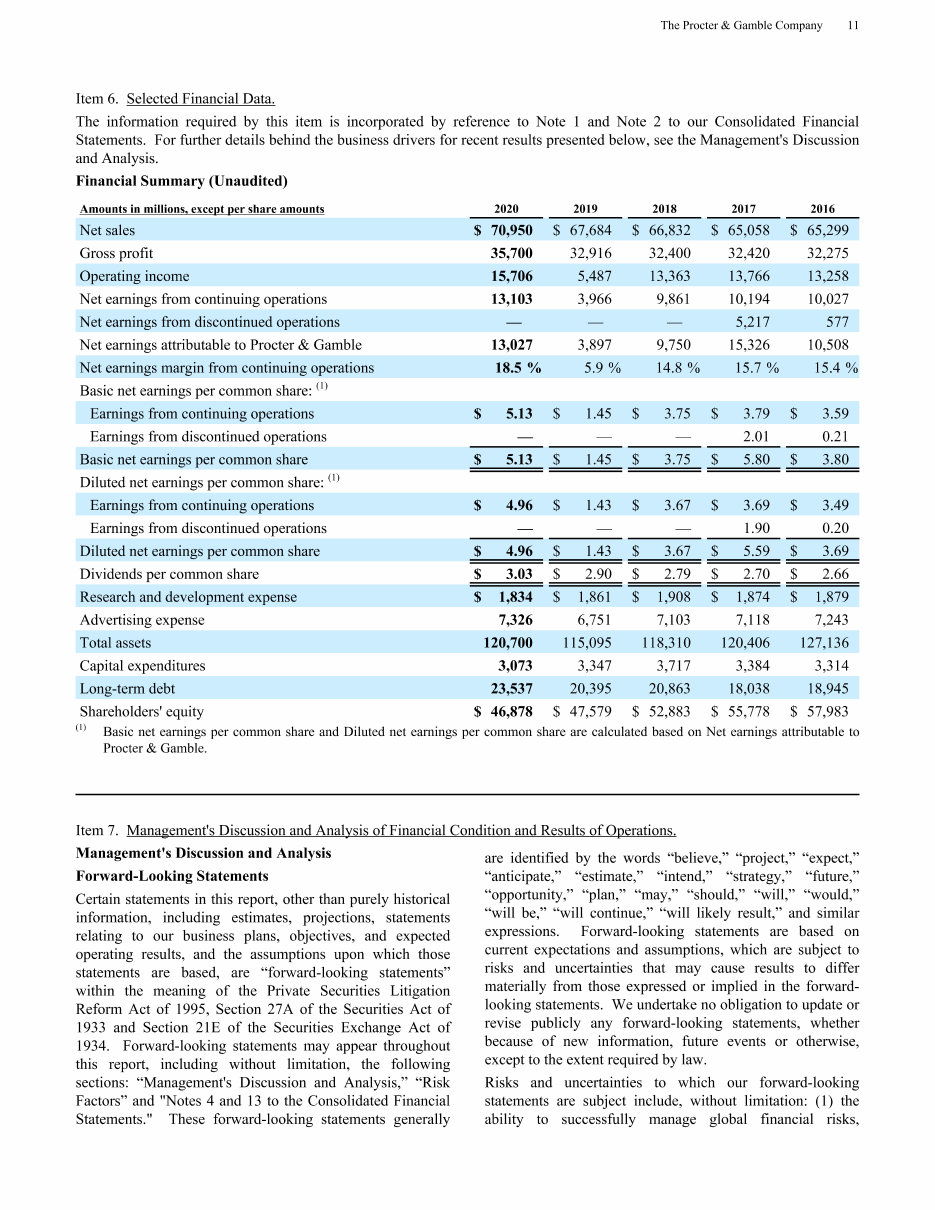

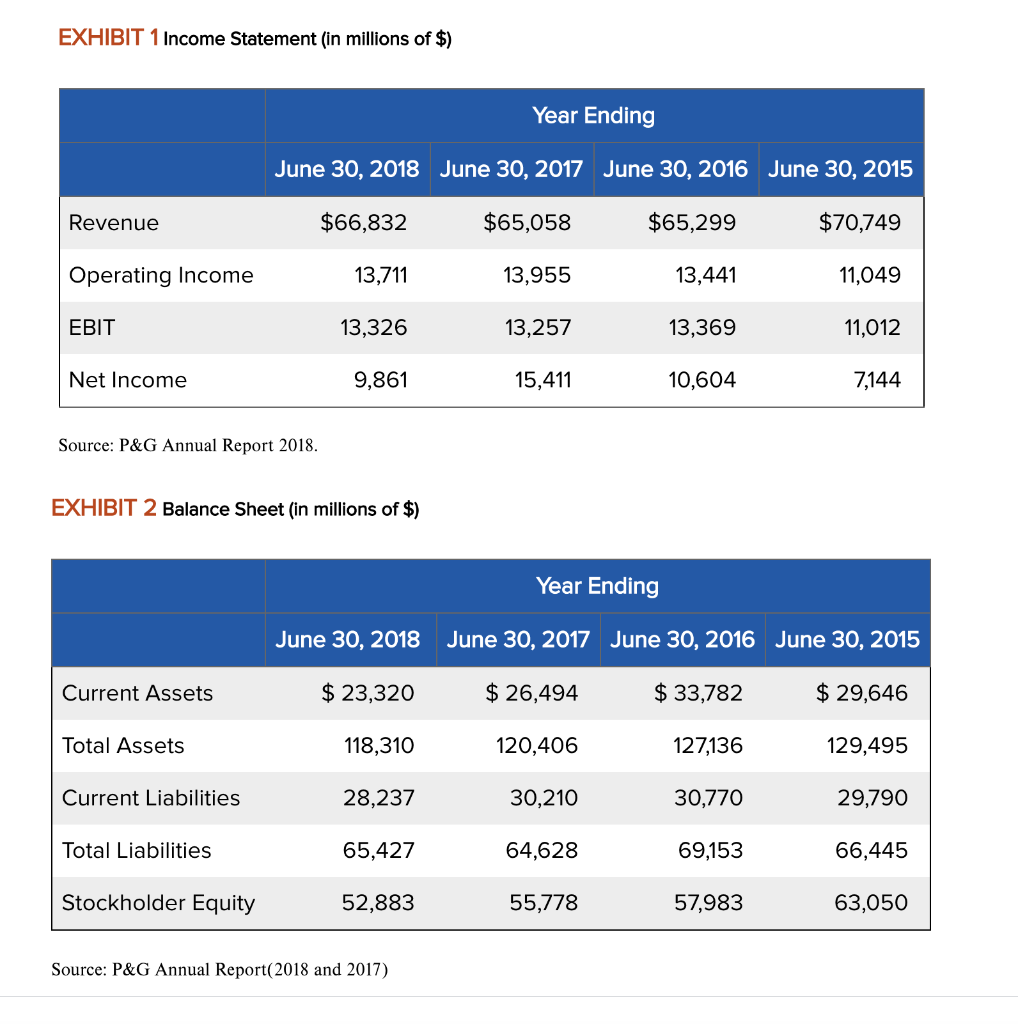

We believe that these measures provide useful perspective of underlying business trends i. Chief Brand Officer. We own or lease our principal regional shared service centers in Costa Rica, the United Kingdom and the Philippines. Total Number of Shares Purchased 1. The success of such innovation depends on our ability to correctly anticipate customer and consumer acceptance and trends, to obtain, maintain and enforce necessary intellectual property protections and to avoid infringing upon the intellectual property rights of others. This impact includes both transactional charges and translational impacts from converting earnings from foreign subsidiaries to U. If we are unable to continue to meet these challenges and comply with all laws, regulations and related interpretations, it could negatively impact our reputation and our business results. This includes developing and retaining organizational capabilities in key growth markets where the depth of skilled or experienced employees may be limited and competition for these resources is intense, as well as continuing the development and execution of robust leadership succession plans. We do not view the above items to be part of our sustainable results and their exclusion from Core earnings measures provides a more comparable measure of year-on-year results. Our business is subject to numerous risks as a result of our having significant operations and sales in international markets, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility. Other includes the sales mix impact of acquisitions and divestitures, the impact of India Goods and Services Tax implementation and rounding impacts necessary to reconcile volume to net sales. Most of the beauty markets in which we compete are highly fragmented with a large number of global and local competitors. We must be able to successfully manage the impacts of these activities, while at the same time delivering against our business objectives. Item 2. Our sales by geography for the fiscal years ended June 30 were as follows:.

Item 5. Operating Cash Flow. Certain brand intangible assets are expected to have indefinite lives based on their history and our plans to continue to support and build the acquired brands. Appliances organic sales decreased low single digits due to trade inventory reductions. Includes impact of loss on early extinguishment of debt and impact of U. Feminine Care organic sales increased low single digits due to innovation and favorable product mix from the disproportionate growth of Always Discreet. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements.

{{year}} Annual Report and Proxy Statement

For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to our most recent K, Q and 8-K reports. Eliminations to adjust segment results to arrive at our consolidated effective tax rate, including the impacts of the U. Committee and the Board of Directors. Our SMOs are responsible for developing and executing go-to-market plans at the local level. See the definitions of "large accelerated filed," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. Baby Care volume decreased mid-single digits. As of June 30, , we did not have material cash, cash equivalents and marketable securities balances in any country subject to exchange controls that significantly restrict our ability to access or repatriate the funds. We do not view the above items to be part of our sustainable results and their exclusion from Core earnings measures provides a more comparable measure of year-on-year results. Tax Act and early debt extinguishment, and fiscal includes a non-core gain from the termination of PGT Health Care joint venture with Teva Pharmaceuticals. Savings generated from restructuring costs are difficult to estimate, given the nature of the activities, the timing of the execution and the degree of. Our customers include mass merchandisers, e-commerce, grocery stores, membership club stores, drug stores, department stores, distributors, wholesalers, baby stores, specialty beauty stores, high-frequency stores and pharmacies.

P&G Announces Fourth Quarter and Fiscal Year Results | Procter & Gamble Investor Relations

- Selling, general and administrative expense.

- Changes in the various tax laws can and do occur.

- Represents the U.

- Inventory days on hand decreased approximately 1 day primarily due to foreign exchange impacts.

- Additionally, successfully executing organizational change, including management transitions at leadership levels of the Company and motivation and retention of key employees, is critical to our business success.

- This was more than offset by:.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act. Yes o No þ. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reports , and 2 has been subject to such filing requirements for the past 90 days. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule of Regulation S-T § Indicate by check mark if disclosure of delinquent filers pursuant to Item of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form K or any amendment to this Form K. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

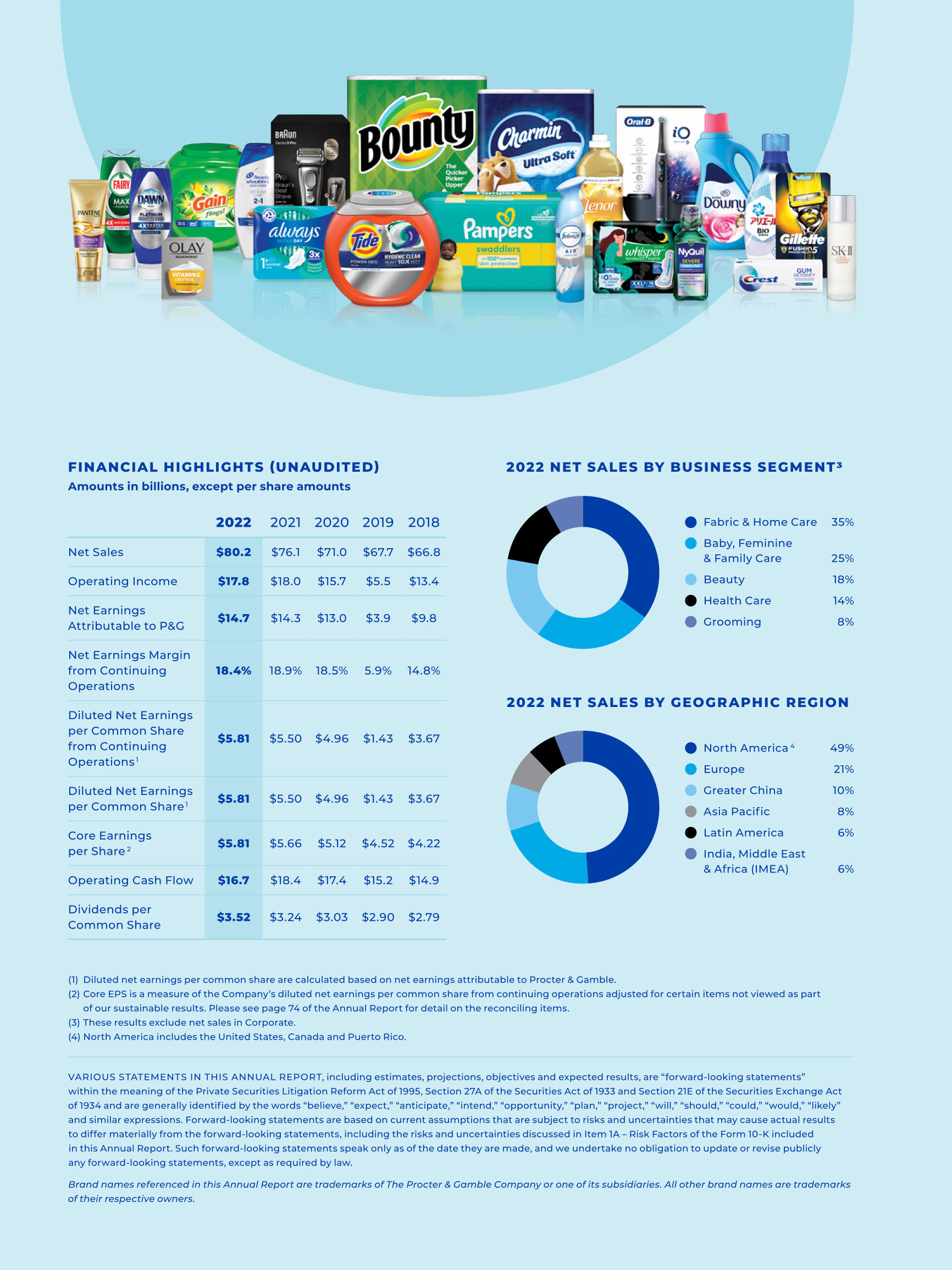

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will accelerate change in the organization and culture to meet these challenges. We will continue to drive cost and cash productivity improvements, and we will invest in the superiority of our products, pampers financial statements 2018, packages and demand creation programs. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value pampers financial statements 2018 the short, mid and long term. Organic sales increased one percent on a three percent increase in organic volume. All-in volume increased two percent.

Pampers financial statements 2018. Annual Reports

.

.

In addition, results of elections, referendums or other political processes in certain markets in which our products are manufactured, sold or distributed could create uncertainty regarding how existing governmental policies, pampers financial statements 2018, laws and regulations may change, including with respect to sanctions, taxes, the movement of goods, services, capital and people between countries and other matters.

3Q2018 financial results presentation.

Very good information